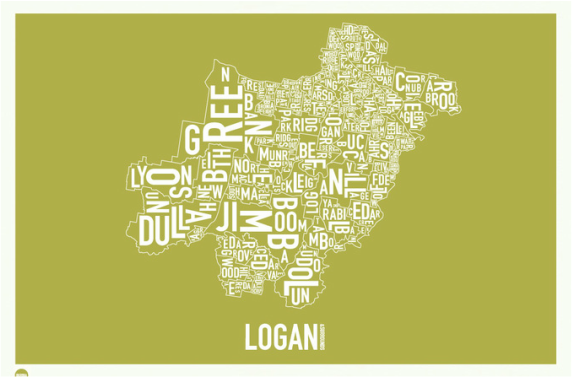

Logan Granny Flats, the largest builder of granny flats in SE Queensland, brings to you another great snippet - something that we have been saying for the last 12 months or so ...

Where to buy your next investment property in Australia ? Why here of course, SE Queensland - Logan area of course, not that we're partial or biased !

So read what the experts are saying, not just us :

Where to buy your next investment property in Australia ? Why here of course, SE Queensland - Logan area of course, not that we're partial or biased !

So read what the experts are saying, not just us :

Margie Baldock

PSD Magazine

11.6.15

PSD Magazine

11.6.15

Last month I explained why understanding the property cycle is vital for property developers. Although for investors it’s about “time in” the market (to allow compounding of returns), for developers property profits are all about “timing”.

It’s much harder to time the market than passively invest for the long haul, but developers who live and breathe the property market over time develop an innate feel for market timing.

Every now and then developers have the joyful experience of being in the right place at the right time, meaning the clear start of a new market growth cycle.

The southeast Queensland market is presenting that exact experience. It’s that once-in-a-cycle moment that comes around every seven to 10 years where confidence returns to a market and buyers begin to line up with gusto.

Numerous experts – who actually understand the property cycle – and groups like CoreLogic RP Data are all singing the same tune. Brisbane and the Gold Coast represent the best value property markets in Australia right now.

Recently John McGrath, who owns 64 real estate agencies nationally, reportedly said: “Anywhere in Queensland will do well but I’d be hard pushed to find anywhere better to invest than the southeast of Queensland in the next three to five years for capital growth.” And frankly I couldn’t agree more.

John pointed out the astonishingly contrasting value for money that investors and homeowners can get in SEQ versus Sydney – $700,000 will buy you a one-bedroom unit in Sydney versus a canal-facing family home on the Gold Coast. This translates into higher discretionary income for those living in SEQ and a better quality of life. And as employment prospects and general confidence improve in the SEQ region, the room for capital growth as these affordable segments enter their growth phase could be substantial.

While Sydney has jumped almost 40 per cent in a few short years, SEQ has just started its recovery and now appears set to have its growth phase, apparently already under way.

What’s positive about the SEQ story is that as regulators (APRA) begin to tighten lending criteria to cool the Sydney boom, this will have the positive effect of locking speculators out of the SEQ growth phase.

This means that only genuine investors with capital or decent incomes will be able to secure property going forward. This is a bit unfair to those wannabes who can recognise the chance to make quick equity by taking a chance on the SEQ fundamentals, as they won’t be able to get funding. However, for developers, we’re far better off selling to solid investors as they can settle every time and we don’t run the risk of selling to buyers who have great intentions but simply can’t stump up come settlement day.

The tightening of lending criteria will mean that the boom phase in SEQ will be slower but more stable and SEQ may avoid a bust at the end of this current strong growth phase also. So, this is good news for developers and investors alike.

It’s much harder to time the market than passively invest for the long haul, but developers who live and breathe the property market over time develop an innate feel for market timing.

Every now and then developers have the joyful experience of being in the right place at the right time, meaning the clear start of a new market growth cycle.

The southeast Queensland market is presenting that exact experience. It’s that once-in-a-cycle moment that comes around every seven to 10 years where confidence returns to a market and buyers begin to line up with gusto.

Numerous experts – who actually understand the property cycle – and groups like CoreLogic RP Data are all singing the same tune. Brisbane and the Gold Coast represent the best value property markets in Australia right now.

Recently John McGrath, who owns 64 real estate agencies nationally, reportedly said: “Anywhere in Queensland will do well but I’d be hard pushed to find anywhere better to invest than the southeast of Queensland in the next three to five years for capital growth.” And frankly I couldn’t agree more.

John pointed out the astonishingly contrasting value for money that investors and homeowners can get in SEQ versus Sydney – $700,000 will buy you a one-bedroom unit in Sydney versus a canal-facing family home on the Gold Coast. This translates into higher discretionary income for those living in SEQ and a better quality of life. And as employment prospects and general confidence improve in the SEQ region, the room for capital growth as these affordable segments enter their growth phase could be substantial.

While Sydney has jumped almost 40 per cent in a few short years, SEQ has just started its recovery and now appears set to have its growth phase, apparently already under way.

What’s positive about the SEQ story is that as regulators (APRA) begin to tighten lending criteria to cool the Sydney boom, this will have the positive effect of locking speculators out of the SEQ growth phase.

This means that only genuine investors with capital or decent incomes will be able to secure property going forward. This is a bit unfair to those wannabes who can recognise the chance to make quick equity by taking a chance on the SEQ fundamentals, as they won’t be able to get funding. However, for developers, we’re far better off selling to solid investors as they can settle every time and we don’t run the risk of selling to buyers who have great intentions but simply can’t stump up come settlement day.

The tightening of lending criteria will mean that the boom phase in SEQ will be slower but more stable and SEQ may avoid a bust at the end of this current strong growth phase also. So, this is good news for developers and investors alike.