The world is quickly grasping the tiny home concept and looking at these homes it’s no wonder! They may be small in size but there is just so much to love about these gorgeous designs. What’s your favourite?

The tiny house revolution told in pictures and floorplans

Patrick Wood, ABC News Breakfast

31 October 2017

31 October 2017

The micro-home fascination is building in Australia as those driven out of the traditional housing market turn to alternative designs.

Author and researcher Catherine Foster has travelled Australia to document how 21 architects have made functional living spaces in 90 square metres or less.

"We're not inventing the wheel, we are repurposing the wheel," she told News Breakfast.

"A few generations ago here in Australia, 90 square metres was a family house.

"It is only in comparatively recent decades that it has crept up and crept up and crept up."

Ms Foster has now released a book, Small House Living Australia, to showcase her findings and outline the floorplans that work.

Author and researcher Catherine Foster has travelled Australia to document how 21 architects have made functional living spaces in 90 square metres or less.

"We're not inventing the wheel, we are repurposing the wheel," she told News Breakfast.

"A few generations ago here in Australia, 90 square metres was a family house.

"It is only in comparatively recent decades that it has crept up and crept up and crept up."

Ms Foster has now released a book, Small House Living Australia, to showcase her findings and outline the floorplans that work.

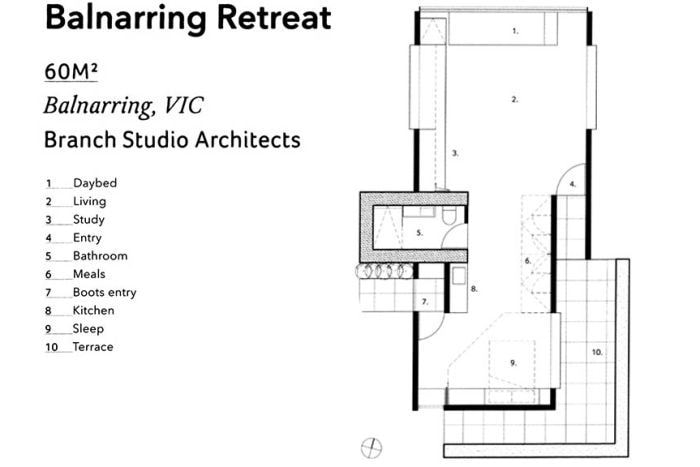

PHOTO: The Balnarring Retreat sits on the water edge in Victoria. (Supplied: Peter Clarke)

PHOTO: The inside of the retreat shows how simple the designs can be. (Supplied: Peter Clarke)

PHOTO: A floorplan of the Balnarring Retreat in Victoria. (Supplied: Branch Studio Architects)

A CommSec study found the average new-home build in Australia in 2015/16 was 231 square metres — just shy of the US average of 249sq/m.

A recent study by Griffith University research fellow Heather Shearer also found a growing interest in small homes in the past two years.

She found people were primarily drawn to the concept for economic reasons, rather than an aesthetic desire.

A recent study by Griffith University research fellow Heather Shearer also found a growing interest in small homes in the past two years.

She found people were primarily drawn to the concept for economic reasons, rather than an aesthetic desire.

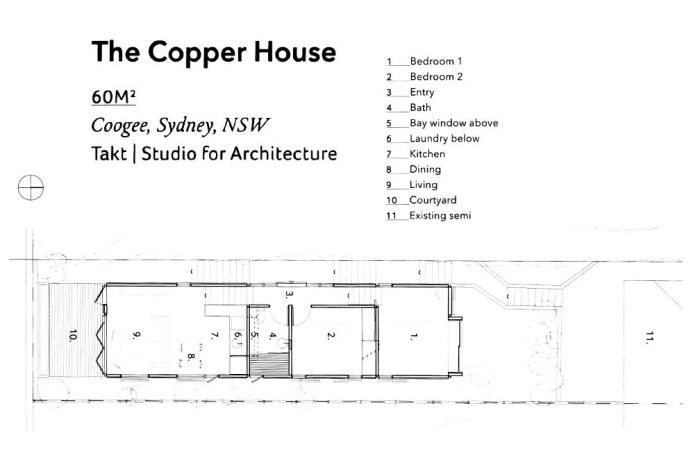

PHOTO: The Copper House in Sydney takes a tiered approach to space saving. (Supplied: Shantanu Starick)

PHOTO: The lounge, outside and dining area show how the Copper House comes together. (Supplied: Shantanu Starick)

PHOTO: The floorplan for The Copper House in Sydney. (Supplied: Takt Studio for Architecture)

"In a possible reflection of the strong demand for urban living, the most important driver was, 'Too expensive property in preferred area'," Ms Shearer wrote.

"Then came: wanting to reduce overall debt, not wanting a mortgage, wishing to downsize, and housing too expensive in general."

Ms Foster said she found people were seeking flexibility as well as affordability, and that lifestyle was a big factor.

"Young people are [saying] 'get me a home' and 'we would rather it not be out in the suburbs an hour along the motorway, we would rather be close to our community'," she said.

"Older people, perhaps downsizing and Baby Boomers are going, 'We want to free up ourselves. We want to go travelling. We want to have a small place where we can go for coffee at the end of the street'."

"Then came: wanting to reduce overall debt, not wanting a mortgage, wishing to downsize, and housing too expensive in general."

Ms Foster said she found people were seeking flexibility as well as affordability, and that lifestyle was a big factor.

"Young people are [saying] 'get me a home' and 'we would rather it not be out in the suburbs an hour along the motorway, we would rather be close to our community'," she said.

"Older people, perhaps downsizing and Baby Boomers are going, 'We want to free up ourselves. We want to go travelling. We want to have a small place where we can go for coffee at the end of the street'."

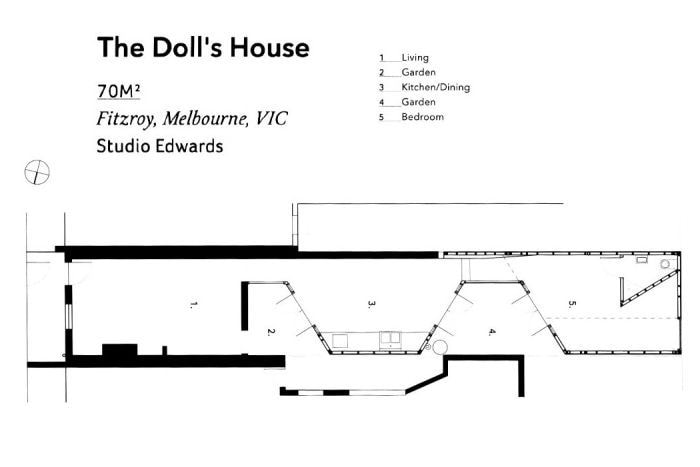

PHOTO: The Doll's House uses two courtyards in the narrow strip to let in light and offer access outside. (Supplied: Fraser Marsden)

PHOTO: The Doll's House in Melbourne hides behind a simple facade. (Supplied: Fraser Marsden)

PHOTO: The floorplans for The Doll's House. (Supplied: Studio Edwards)

When it came to successfully creating a smaller living space, Ms Foster said they key word was "multifunctional".

"No longer do you have a dedicated room for a laundry or a dedicated room for a TV or whatever. You are going to have those shared," she said.

"The dining room would be an integrated thing within the living space … they are all there."

"No longer do you have a dedicated room for a laundry or a dedicated room for a TV or whatever. You are going to have those shared," she said.

"The dining room would be an integrated thing within the living space … they are all there."

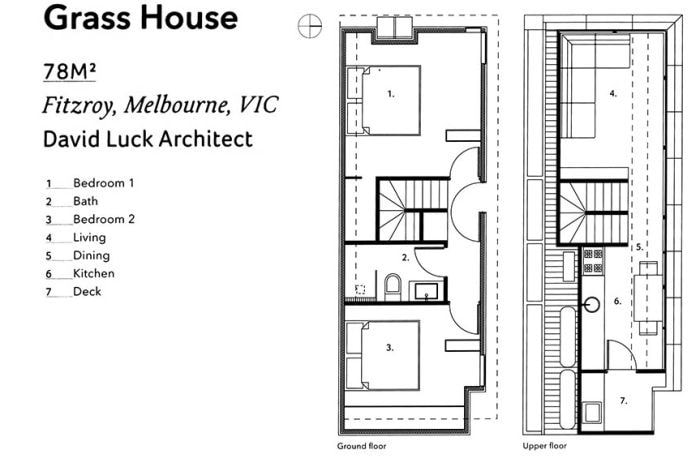

PHOTO: The Grass House has a combined kitchen, dining and living area. (Supplied: Daniel Dixon)

PHOTO: High ceilings create a feeling of space without increasing the floor size. (Supplied: Daniel Dixon)

PHOTO: The floorplan for the Grass House. (Supplied: David Luck Architect)

Share your tiny home ideas and desires with us…we might just

be able to help make your wishes come true!

Call Sonia on 0403 309 136

be able to help make your wishes come true!

Call Sonia on 0403 309 136