Whether it’s to pay off your mortgage faster, or simply giving you some extra cash to pocket, read on to discover why dual-income investment is a great opportunity for you:

22 April 2016

A dual-income investment is effectively what is says on the tin – a property that provides two incomes to an investor, by way of two separate rental agreements. It may be a granny flat, a duplex, dual occupancy, or a dual-key property.

All property types have provision for two incomes, but each differs slightly in its presentation, cost, and buyer/renter appeal.

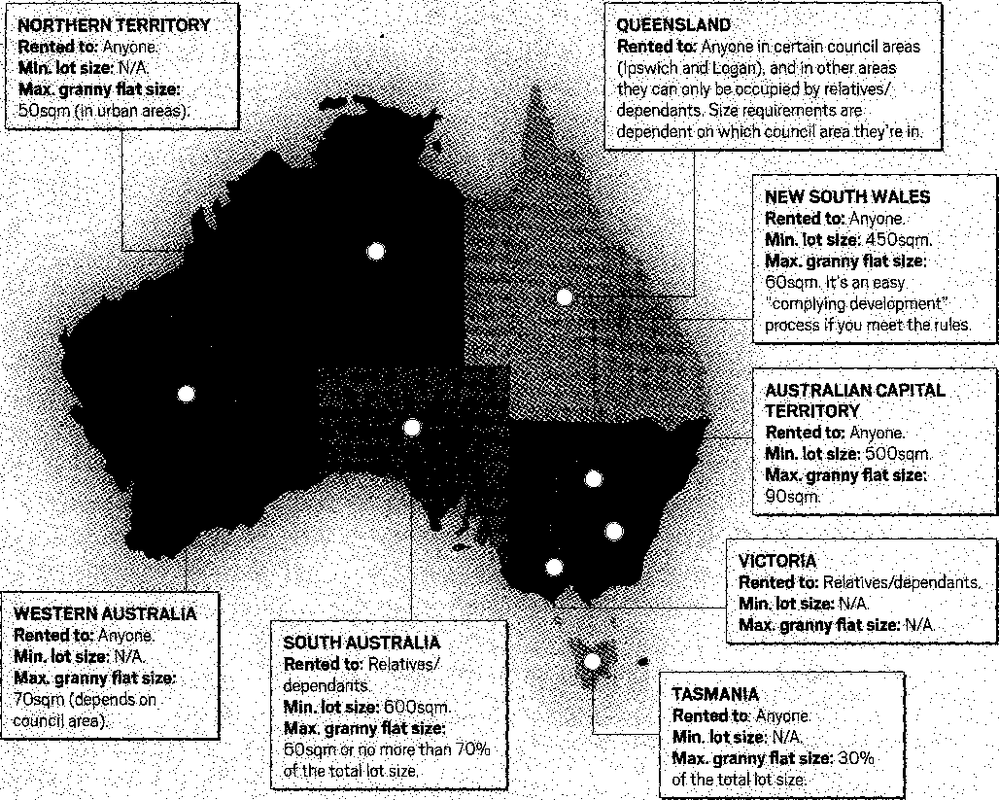

A granny flat is an additional dwelling, typically the same size or smaller than a studio apartment, usually situated in the backyard of an existing property. Some granny flats don’t require council approval for construction, and in recent years, particularly in markets such as Sydney, they have become an increasingly popular addition to many suburban homes.

A duplex is two adjoining properties on the same title (in a majority of cases) – or a residential building divided into two apartments/townhouses. Although duplexes can be sold individually, investors can choose to construct them as a way of gaining a larger number of properties from the one plot of land. Each side of a duplex is typically identical to the other, as this maximises building and material efficiencies.

Dual-occupancy properties are similar to duplexes in that they refer to two properties on the one plot of land, but they do not necessarily have to be adjoining. For example, on a larger plot of land, say in a rural residential area, two properties may exist on the one plot of land. Dual-occupancy properties will typically share infrastructure such as entrances and driveways.

Dual-key properties refer to properties with floorplans which allow for an area of the residence to be locked off for separate use. Each resident may share common facilities such as the front door, but have access to separate areas of the property for their living quarters and kitchen facilities.

Advantages of dual-income investments include:

- Maximising the potential of one block of land: instead of having a single property on a large block of land, you can utilise more of the space available to you

- Improved cash flow, which can contribute to your loan servicing capacity

- Reduced maintenance costs

- Increased portfolio size without the cost of outlay associated with buying two properties

Disadvantages of dual income investments

- Reduced property desirability: many owner-occupier buyers may not be attracted to a dual-income investment. The design may not suit their requirements, or they may simply not be attracted to the idea of having another property attached, or in close proximity, to their residence

- The risk of over capitalising: it’s very easy to spend money on developing a dual-income investment that may not be reflected in the value of the overall property. For example, while granny flats can be a cheap entry point into property investment, it is very easy to develop them to a higher level which may not be reflected in the asking price come sale time

- Minimal contribution to equity: following on from the previous point, the lack of market value attached to some dual-income properties means that they may not be the best vehicle for enhancing equity, and therefore increasing your borrowing capacity

- Being stuck with multiple vacant properties in the one area: diversification is the key to avoiding the risks associated with property investment, and dual-income investments run the risk of being stuck with two losses of income, not one, if the market takes a turn for the worse in that area

- When it comes to sales time, it may be impossible to sell the properties separately (with the exception of some duplexes). This has the potential to present significant challenges

- If you want to pass on the cost of some utilities, such as water expenses, to each of the properties in your dual-income setup, you will need to spend the extra funds required to establish separate meters for each property

What you need to know before you buy a dual-income investment

Unless the investment is simply establishing a basic granny flat in your backyard, the lack of equity sometimes generated by a dual-income investment may mean that it’s not the best investment option for those just starting out. You could potentially spend a lot of capital establishing a dual-income property that, while providing a high yield, may not allow you to establish your investment portfolio as fast as you would like.

For investors with a well-established portfolio, who can afford the significant outlay of establishing a dual-income investment and are at the stage where they want a high-yielding asset to improve their cash-flow situation, a dual-income investment may be a worthy consideration.

It’s important to remember that design considerations are key to a successful dual-income investment, particularly if it’s a duplex or dual-key investment. If you’re buying a property off-the-plan from a builder, or choosing a standard floorplan, be sure to understand the room configurations and flow, the bedroom and living room sizes, the available storage and general finishes, the orientation and whether this is in line with the expectations of the renter demographic in the area.

LOOKING FOR AN INVESTMENT PROPERTY IN IPSWICH?

WHAT ABOUT LOGAN OR THE MORETON BAY REGION?

WANT IT SPECIFICALLY TO BUILD A GRANNY FLAT

and

RECEIVE DUAL INCOMES?

We can act as Buyer’s Agents on your behalf!

For more information

CALL SONIA 0403 309 136