A great article here showing what tenants and buyers are putting at the top of their wish lists! Pools and granny flats can add so much appeal to your property, creating both lifestyle and financial attractions. Even something as simple as adding a shed might just make your property stand out above the one down the road. The article may be written about WA properties but our experience tells us that it’s just the same here in QLD! Have a think about what you can do to your property to make it more in demand…

Why pools rule the real estate hunt

Josh Zimmerman, PerthNow

October 8, 2017

October 8, 2017

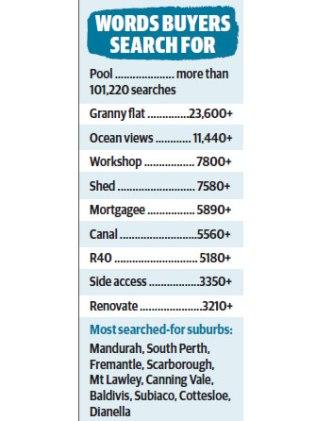

PROPERTY hunters scouring the internet have pools and granny flats at the top of their wish list, while Mandurah is the most popular suburb for real estate clicks.

Mandurah has powered to the top of realestate.com.au search ranks thanks to retirees looking to cash in on their ageing Perth homes and escape the hustle and bustle of city life, according to property experts.

The coastal community topped WA search rankings for the past two years and is on track to defend its crown again in 2017, with more than 172,000 searches up to last month.

Swimming pools are by far the most sought-after feature, racking up more than 101,220 searches this year, with hard-to-shift adult children and the revenue on offer through short-stay accommodation leading granny flats (23,600) into second.

REA Group chief economist Nerida Conisbee said Mandurah’s popularity reflected a growing trend across Australia.

“The kind of lifestyle on offer is becoming more and more important for people buying a house but they also don’t want to pay too much for the privilege of being near amenities or the beach,” she said.

With a median house price of $290,000, Mandurah remains significantly cheaper than the Perth average of around $500,000.

Mandurah has powered to the top of realestate.com.au search ranks thanks to retirees looking to cash in on their ageing Perth homes and escape the hustle and bustle of city life, according to property experts.

The coastal community topped WA search rankings for the past two years and is on track to defend its crown again in 2017, with more than 172,000 searches up to last month.

Swimming pools are by far the most sought-after feature, racking up more than 101,220 searches this year, with hard-to-shift adult children and the revenue on offer through short-stay accommodation leading granny flats (23,600) into second.

REA Group chief economist Nerida Conisbee said Mandurah’s popularity reflected a growing trend across Australia.

“The kind of lifestyle on offer is becoming more and more important for people buying a house but they also don’t want to pay too much for the privilege of being near amenities or the beach,” she said.

With a median house price of $290,000, Mandurah remains significantly cheaper than the Perth average of around $500,000.

Ms Conisbee said swimming pools consistently topped search rankings nationwide and granny flats were becoming more sought after as children waited longer to leave the nest and, since the advent of websites such as Airbnb, were also viewed as lucrative money-spinners in the right location.

“If you’re in Scarborough or Mandurah or a nice beachy area, having a granny flat for short-term accommodation definitely offers a financial return,” Ms Conisbee said.

Raine and Horne real estate sales consultant Randolph Watson said he was enjoying the busiest period of his six-year career with over-50s flocking to join Mandurah’s laid-back coastal community.

“Mandurah has always been known as a holiday destination and has that holiday feel year round,” Mr Watson said. “We’ve got the most extensive canal system in the whole of WA and a water lifestyle that no other region can offer.”

Mr Watson said Mandurah also boasted world-class health facilities, extensive shopping and easy access to Perth by rail.

He said many Mandurah buyers were motivated by the value on offer, especially retirees looking to unlock equity in family homes closer to Perth.

“Often the homes they are living in are getting old and dated,” he said. “They can come to the Mandurah or Peel region and find the lifestyle they want, buy a home that is much more modern and also bank some cash.”

“If you’re in Scarborough or Mandurah or a nice beachy area, having a granny flat for short-term accommodation definitely offers a financial return,” Ms Conisbee said.

Raine and Horne real estate sales consultant Randolph Watson said he was enjoying the busiest period of his six-year career with over-50s flocking to join Mandurah’s laid-back coastal community.

“Mandurah has always been known as a holiday destination and has that holiday feel year round,” Mr Watson said. “We’ve got the most extensive canal system in the whole of WA and a water lifestyle that no other region can offer.”

Mr Watson said Mandurah also boasted world-class health facilities, extensive shopping and easy access to Perth by rail.

He said many Mandurah buyers were motivated by the value on offer, especially retirees looking to unlock equity in family homes closer to Perth.

“Often the homes they are living in are getting old and dated,” he said. “They can come to the Mandurah or Peel region and find the lifestyle they want, buy a home that is much more modern and also bank some cash.”

After years living in Canning Vale, David and Lesley Wakefield recently bought a four-bedroom, two-bathroom home with a swimming pool on a 750sqm block in Pinjarra, just outside Mandurah.

“We don’t want to be living on top of anybody else,” Mrs Wakefield said. “Pinjarra is even slower-paced than Mandurah which is a big attraction for us. We’ve got no need for shopping and big crowds.”

“We don’t want to be living on top of anybody else,” Mrs Wakefield said. “Pinjarra is even slower-paced than Mandurah which is a big attraction for us. We’ve got no need for shopping and big crowds.”

Our experience tells us that tenants and buyers and looking for the same things here in South East Queensland! Talk to us about ways to enhance your property to ensure you are getting top returns when it comes time to rent or sell.

Call Sonia and the team on 0403 309 136 – we’re here to help!